The Payment Card Industry Data Security Standard (PCI DSS) is a set of rules and guidelines designed to ensure organizations that handle credit card information protect that data securely. It’s essentially a set of best practices to reduce credit card fraud.

Forms/Types of the Payment Card Industry Data Security Standard

There aren’t exactly different forms or types of PCI DSS itself. PCI DSS is a single set of security requirements. However, there are different Self-Assessment Questionnaires (SAQs) that merchants use to determine their PCI compliance level.

The SAQs are designed to help merchants efficiently assess their PCI compliance based on their business model and how they handle cardholder data. Here are the different types of SAQs:

- SAQ A: For merchants that outsource all cardholder data storage, processing, and transmission to a PCI-DSS validated service provider.

- SAQ C-VT: For merchants that take payments through virtual terminals.

- SAQ P-EI: For merchants that use payment facilitators to process their transactions.

- SAQ POI (Point-of-Interaction): For merchants that take payments in person.

- SAQ WEB: For merchants that take payments through their website.

The specific SAQ a merchant needs to complete depends on their specific business and how they accept credit card payments.

You can compare PCI DSS to the security system at a high-security embassy. Not everyone is allowed to have, see, or handle a passport. Giving too many people entry to a country means that you open yourself up to more risk. In the same way, PCI DSS makes sure that only authorized people are allowed to access data.

Why Should Businesses Care About the Payment Card Industry Data Security Standard?

Here’s why businesses should care about the Payment Card Industry Data Security Standard (PCI DSS):

- PCI DSS Protects Businesses from Costly Data Breaches: A data breach can be devastating for a business. PCI DSS helps prevent these by mandating strong security measures, saving businesses from the financial burden of recovering from a breach, including notifying customers, replacing cards, and potential fines.

- PCI DSS Maintains Customer Trust: Customers trust businesses with their sensitive financial information. PCI DSS compliance demonstrates a commitment to data security, fostering trust and loyalty with customers. A data breach can severely damage customer trust, potentially leading to lost business.

- PCI DSS Avoids Fines and Penalties: Failing to comply with PCI DSS can result in hefty fines from credit card companies. These fines can be significant, especially for businesses that process a high volume of transactions.

- PCI DSS Minimizes Risk of Legal Action: Data breaches can lead to lawsuits from customers whose information was compromised. PCI DSS compliance helps mitigate this risk by demonstrating a proactive approach to data security.

- PCI DSS Maintains Payment Processing Ability: Non-compliance with PCI DSS can lead to the termination of a business’s ability to accept credit card payments. This can significantly cripple a business’s sales and revenue.

PCI DSS compliance is not just about following rules, it’s about protecting your business, your customers, and your reputation. It’s an investment in building a secure environment for handling sensitive financial data.

The Payment Card Industry Data Security Standard In the Context of Cybersecurity Frameworks

The Payment Card Industry Data Security Standard (PCI DSS) fits within the realm of cybersecurity frameworks as a specific and focused standard that complements broader frameworks.

Cybersecurity frameworks like NIST Cybersecurity Framework (CSF) or ISO 27001 provide a more general set of guidelines for managing information security across an organization. PCI DSS, on the other hand, is a narrowly targeted standard that concentrates solely on safeguarding cardholder data.

PCI DSS can be seen as a building block that integrates with broader frameworks. The controls outlined in PCI DSS directly map to some of the core security objectives defined in these frameworks. This allows organizations to achieve compliance with both PCI DSS and a broader security framework in a cohesive manner.

While PCI DSS mandates specific controls to achieve compliance, broader frameworks emphasize risk management. Organizations can leverage these frameworks to identify and prioritize security risks related to cardholder data, and then implement PCI DSS controls to address those specific risks.

Related Systems or Technologies

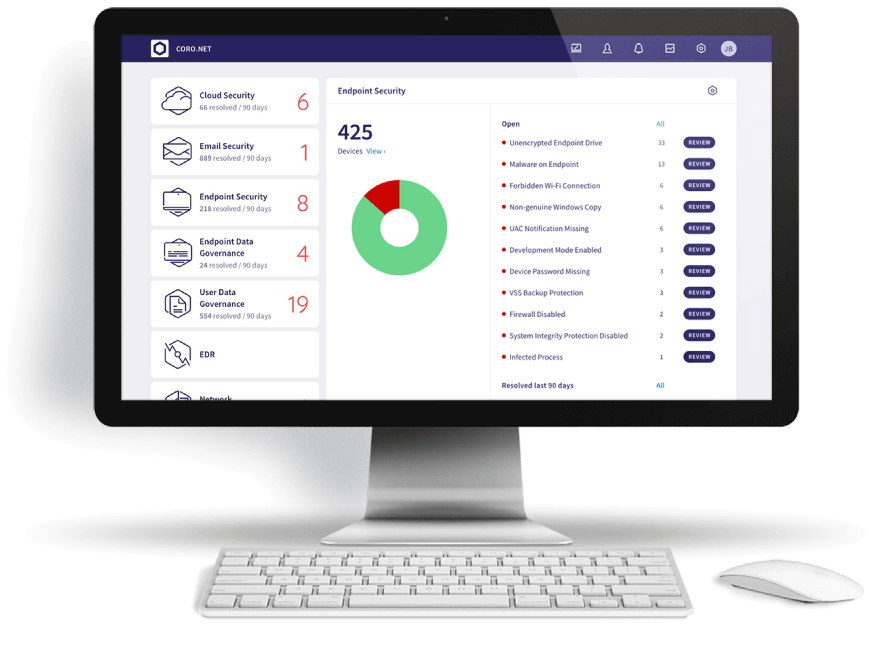

There are several related systems and technologies that can help businesses achieve PCI DSS compliance:

- Firewalls: These act as security barriers that control incoming and outgoing network traffic, similar to a castle gatekeeper. PCI DSS mandates firewalls to restrict access to sensitive cardholder data.

- Data Encryption: This scrambles data using codes, making it unreadable without a decryption key. PCI DSS requires encryption for cardholder data at rest (stored) and in transit (being transmitted). Think of it like a secret code for your financial messages.

- Vulnerability Scanning and Penetration Testing: These are proactive measures to identify weaknesses in a system’s security. Vulnerability scans are automated checks for known security holes, while penetration testing simulates real-world attacks to uncover exploitable weaknesses. Imagine having security experts regularly checking your embassy’s defenses for vulnerabilities.

- Security Information and Event Management (SIEM) Systems: These tools collect and analyze security data from various sources, helping businesses identify and respond to security incidents. SIEM systems act like a central command center monitoring all security activity within the embassy.

- Access Control Systems: These restrict access to sensitive data and systems based on user roles and permissions. PCI DSS requires limiting access to cardholder data only to authorized personnel. Imagine issuing special access badges to authorized personnel within the embassy.

- Tokenization: This replaces actual cardholder data with unique identifiers (tokens) during transactions. This reduces the amount of sensitive data a business needs to store. Think of using a code name for your passport instead of carrying the actual document everywhere.

Related Regulations or Compliance Goals

PCI DSS is specifically focused on protecting cardholder data, but it intersects with some other regulations and compliance goals that share similar objectives:

- General Data Protection Regulation (GDPR)

While GDPR doesn’t directly mandate PCI DSS compliance, there’s significant overlap in the security controls required for protecting personal data, including credit card information. Achieving PCI DSS compliance can help organizations meet some of the GDPR requirements for securing personal data.

- National Institute of Standards and Technology (NIST) Cybersecurity Framework (CSF)

This is a voluntary framework that provides a set of best practices for managing cybersecurity risks. While broader than PCI DSS, the NIST CSF incorporates many security controls that align with PCI DSS requirements. Organizations aiming for PCI DSS compliance can leverage the NIST CSF to establish a more comprehensive information security program.

- HIPAA (Health Insurance Portability and Accountability Act)

This regulation applies to healthcare providers and protects the privacy and security of patients’ protected health information (PHI). While HIPAA has its own set of security requirements, some controls overlap with PCI DSS, particularly those related to access control, data encryption, and risk management. A PCI DSS compliant environment can provide a strong foundation for HIPAA compliance for healthcare providers that also handle credit card information.

- SOC 2 (Service Organization Controls)

This is an auditing standard for service providers that demonstrates their ability to securely manage customer data. SOC 2 audits can cover controls relevant to PCI DSS, but with a broader scope. An organization that achieves a SOC 2 report that includes controls relevant to PCI DSS would inherently be PCI DSS compliant as well.